Tax increment finance districts are tools that government bodies can use to help grow a community, and the city of Warsaw has been doing that, according to officials.

During the Warsaw Redevelopment Commission meeting Monday, Jeremy Skinner, the city’s community development coordinator, presented the Commission’s annual financial report for 2021, including information on the city’s TIF districts. The board also held a public hearing on the report and Skinner’s presentation.

Skinner reminded the Commission that he gave them a copy of the report in March to review. The report presented Monday was the final version.

“It meets all of our requirements in terms of meeting the Indiana Code,” he said. “So you’ll see it has Redevelopment Commission members, Redevelopment Authority members, has any paid employees of the city that the Redevelopment Commission pays a portion of salary.”

The financial report covers what they did and accomplished in 2020, as well as beginning and ending balances and expenditures for 2020 for each TIF district.

“This is the first year that Eastern TIF was combined with Northern TIF in 2018, so this is the first year without an Eastern TIF budget, so those two combined and they’re just the Northern TIF. Next year, we’ll see both the residential TIF districts show up on the report,” Skinner said.

The report shows the 2021 budgets being the Northern TIF, Central TIF, Winona Interurban and the Technology Park, Skinner said.

The plans and projects accomplished for each of the TIF districts also are listed in the annual report. As an example, Skinner said, “So some of the things we’ve accomplished: Phase 2 for 300 North project was finished last year. And we’re doing engineering for Phase 3 this year, and that’s in the Northern TIF district. We also have the Anchorage Road project that’s in the engineering stage now.”

The financial aspects of the report cover any bond issue, outstanding principle, fiscal year, the debt and expiration date.

At the end of the report, Skinner said there’s an overview of projects coming up for 2021-23.

The report also was presented to the Warsaw Common Council Monday night.

The Warsaw Technology Park is part of the annual report, but Skinner said it was a “little bit different” than the TIF districts. It doesn’t collect TIF revenue, but collects state income and sales taxes. It is in the Northern TIF district. “I did include that in this report as well just so you have that information for budgeting purposes when we do budgets in June,” Skinner said.

In the report is a segment looking at the potential impact of TIF on overlapping taxing units. Skinner said over the last three to four years of creating the annual report, he’s broken down the TIF projects that were created through TIF revenue.

The meeting was opened to the public for the public hearing on the report and Skinner’s presentation, which he then commenced.

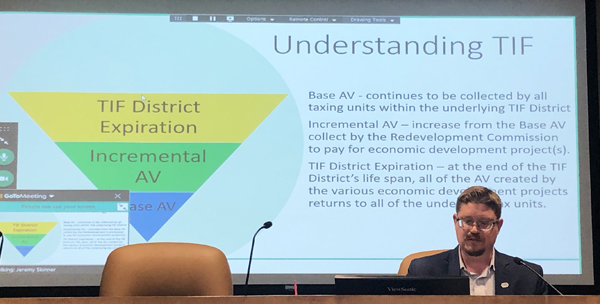

Skinner provided a basic understanding of TIF. The base assessed valuation (AV) continues to be collected by all taxing units within the underlying TIF district. The incremental AV is an increase from the base AV collected by the Redevelopment Commission to pay for economic development project(s). At the end of the TIF district’s life span, all the AV created by the various economic development projects return to all of the underlying taxing units.

A large portion of the Northern TIF expires in 10 years.

“The primary impact is the tax collected and the tax rate. The secondary impact would be jobs created, commercial and residential growth; income, sales, payroll taxes collected – all of those are collected outside of the TIF district,” he said.

Over the years, Skinner said the community has been “very fortunate” because the tax rates in the county, city, township and schools have been “very well managed, very flat, very little increases.” Budgets have been steady, with no dramatic increases, he said.

The TIF districts have been in operation since 1990. “So I know there’s a lot of arguments about ‘TIF district takes taxes away and causes tax rates to go up,’ and so forth, but if you look at what has occurred in Kosciusko County – whether you’re the county, city or school – for the most part, we’ve been steady. Our growth has been steady. There have not been any large increases,” Skinner stated, adding that the AV growth has steadily grown in the city, county and schools.

Two residential TIF districts were created in 2019 in the city. Warsaw Community Schools Superintendent Dr. David Hoffert asked Skinner, “What are you seeing in new housing here inside the community? I know we’re coming out of the pandemic, but have you seen an increase in home builds, or do you know where we’re at, or is it too soon to say that?”

Skinner said in 2020, home builds in the community were “pretty average” and the pandemic played a part in that. The first three months of this year were not likely to resolve that impact for this year.

“But the conversations I’m having right now, as potential developments we’re talking about, (the residential TIF districts) will have an impact on the next three to five years,” Skinner said. “So I have an optimistic forward-looking view at where we’re going to be three years from now.”

Hoffert asked if there were a higher percentage of home builds this year compared to this time in 2020. Skinner said in 2020, it was “pretty average” with “not much of an increase.” He was optimistic that in the next two years there will be an increase. “And the reason I’m saying that is, the conversations I’m having right now with developers. We’re talking to potentially four different developers right now with four different projects that don’t exist right now.”

Skinner said he was excited for what 2022, 2023 and 2024 may look like.

After the public hearing portion of the meeting was closed, Mayor Joe Thallemer told the Redevelopment Commission, “So this is obviously a really important report. Jeremy spent a lot of time on it, working with the school corporations and all the overlapping units of government. To understand TIF is the most important thing we’re trying to do. And, hopefully, through these discussions and these public documents and public filings that we have to make, we will all understand the importance of what the investment that our TIF increment generates, the projects and then that resulting growth in the community, growth in the tax base. Hopefully, growth in enrollment in the schools. Participants in the library, and everything else.”

He continued that the city – more importantly the Redevelopment Commission – has taken quite the lead in growing the community.

“… I truly feel like we’re utilizing (TIFs) in our community for the benefit of everyone. We’re using it to create economic development, to improve housing, to improve all the things that make this a desireable community,” Thallemer said.

Redevelopment Commission President Tim Meyer said, “Tax increment financing is really a tool for us to use, from a financial standpoint, to help grow the community. This group has to work within the regulations and state laws, and do so prudently, in an effort to increase the growth of our entire community. And it has been successful in prior years and we continue to project that out to the near future based on what we know.”