Last year, OrthoPediatrics celebrated its 10th anniversary with growing sales and a slew of announcements about new products.

This year, the Warsaw company will face its first real competition as local firm WishBone Medical begins operations in what is viewed as one of the last untapped segments of the orthopedic industry.

With virtually no competition, OrthoPediatrics has thrived, building a presence in more than 30 countries.

“There are a number of companies that have products that address pediatric care in some form or fashion. However, we’ve long considered ourselves the first and only company that’s focused exclusively on pediatrics,” said Mallory Trusty, a spokesperson for OrthoPediatrics.

The company, which added staff last year, has about 60 employees and wants to hire more engineers.

OrthoPediatrics moved to its Ind. 15 North facility — a former car dealership — a few years ago. The showroom was converted into office space for its engineering staff. The old oil change bays were renovated into a distribution center.

The property was purchased with room to grow, which might become necessary soon, given the growth it has experienced.

Both firms embrace the new-found competition.

“We are excited to see someone else in the industry,” Trusty said. “Our company was founded to care for children, and it’s great to see another company recognizing that need.”

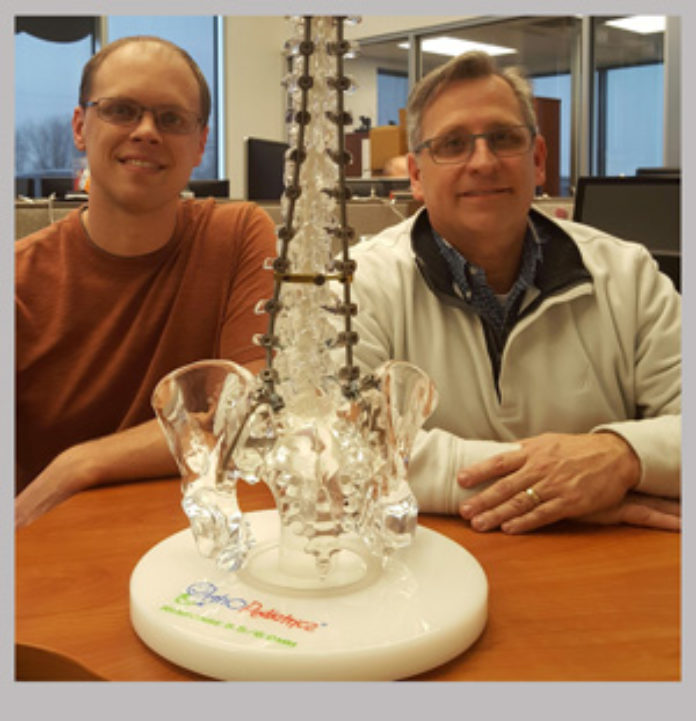

“It’s actually pretty exciting,” agreed Nick Deeter, WishBone Medical’s founder. “I love the kids’ market and I enjoy children and helping them. There’s nothing more gratifying than to go into a surgery with a cerebral palsy child and provide a product that can help them.”

Deeter is intimately familiar with OrthoPediatrics. He founded the company, but left a few years ago.

WishBone has a facility on North Pointe Drive and will start with about 15 employees.

Deeter said WishBone has been working behind the scenes for a while and tentatively plans to roll out its first products this year.

The changing political climate pushed by President Donald Trump, who campaigned on a pledge to reduce corporate taxes and regulations, accelerated Deeter’s decision to publicize the company’s launch.

“It was more of the results of the election in November that was the trigger to move forward,” Deeter said. “It was like somebody took a wet blanket off the marketplace.”

Another factor is the widespread belief that the medical device tax, already suspended, will soon be killed by Congress.

Deeter believes only about 5 percent of the pediatric orthopedic market — from birth to age 21 — has been tapped, leaving plenty of potential.

He said WishBone will follow a slightly different business model by marketing complete kits to hospitals and expanding its reach beyond children’s hospitals.

Another factor that bodes well for pediatric orthopedics, Deeter said, is aging millennials who are starting families.

He said he believes millennials are prone to turning to the internet to learn more about medical trends for their children before making decisions.

“They’re very well-educated and demanding,” Deeter said. “I think the millennial population will drive our marketplace.”